- GENERAL ASSESSMENT

- MANAGEMENT

-

CORPORATE GOVERNANCE PRACTICES

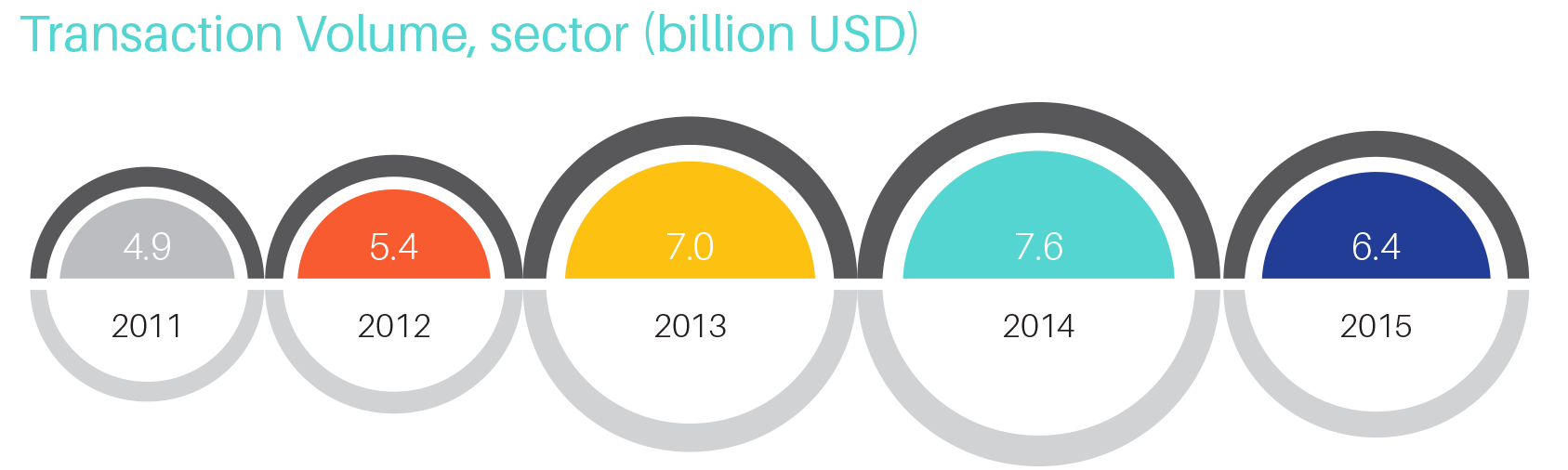

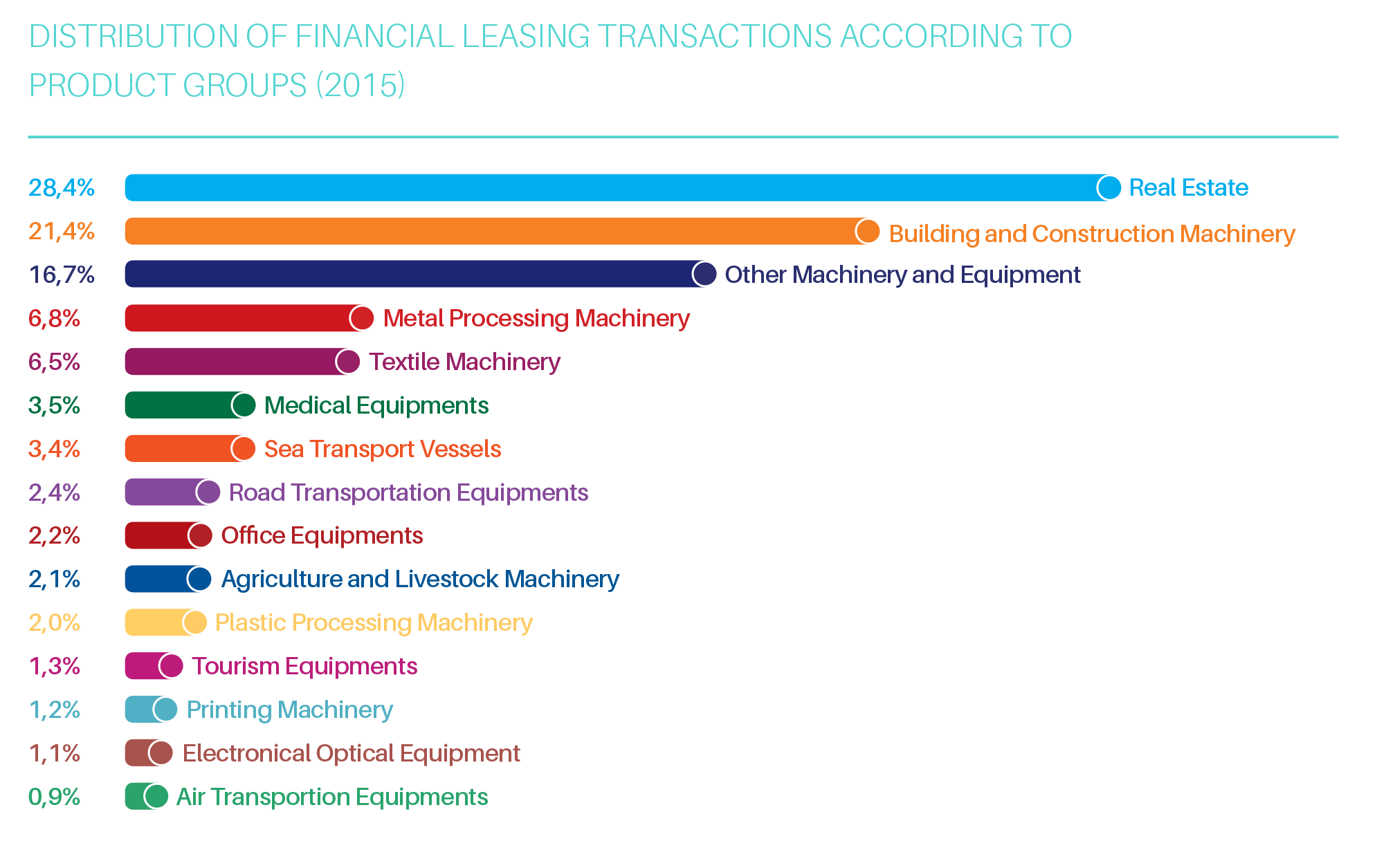

- Brief Annual Report of The Board of Directors

- Changes Within The Report Period

- Company Risk Policies

- Profit Distribution Policy

- Disclosure Policy

- Company Ethical Principles

- Declaration of Corporate Governance Rules

- Compliance Report on Corporate Governance Principles

- Declaration of Internal Control Environment

- Agenda of The General Assembly

- Amended Draft of The Articles of Association

- Profit Distribution Proposal

- Board Decision Regarding Financial Statements

- Audit Committee Decision

- FINANCIAL STATEMENTS