What was the basic strategy of your Company, and how was it implemented, in 2013?

What was the basic strategy of your Company, and how was it implemented, in 2013?

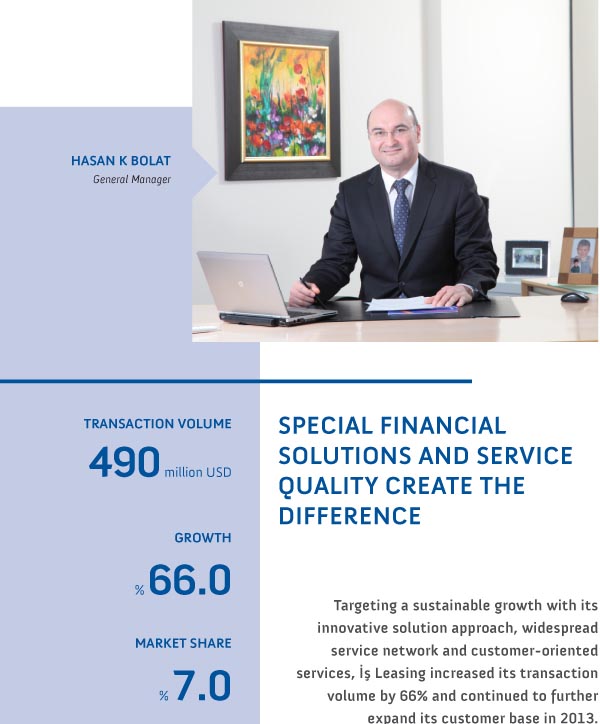

Our basic strategy is to continuously monitor the areas of needs and demands of our customers, and to produce solutions fit for needs with our competent and dynamic human resources, and to create value for investments with our innovative, flexible and top quality service approach. To this end, we have first of all evaluated our business processes, regional organization, portfolio and funding sources, and issued and implemented the required regulations. We have further strengthened our business processes based on efficiency and customer-oriented approach which differentiate us in the competition.

Upon evaluation of our regional organization structure, we have increased the number of our branch offices by organizing new organization units in the regions having a potential. As a result of efficiency analyses conducted by considering our existing human resources structure and our business processes, we have determined the optimum staff and completed the required personnel recruitments.

With a view to creating cost-effective sources consistent with repayment maturities of the projects financed by us, and by extensively using IFC (International Finance Corporation), country Eximbanks, bond issue, murabaha and the Gulf capital, we continued our policy of diversifying our funding sources and reducing the costs of sources and extending the costs to long-term.

What are the important factors of your success achieved in 2013?

In

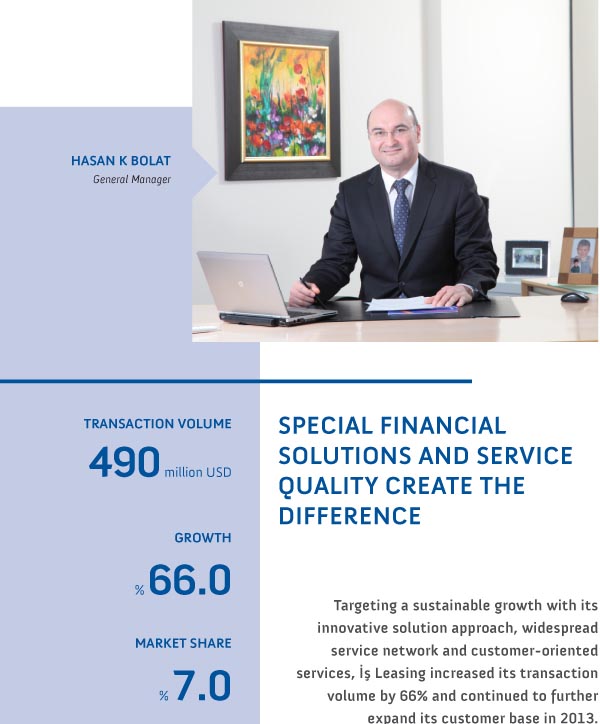

2013, our transaction volume reached a level of

490 million USD, representing a growth of

66% in comparison to the figures of past year. It is unequivocal that our strategy of creating a widespread portfolio, continued by us with concentration since the last few years, has been effective on this volume increase.

Our weight given to construction machinery and manufacturing machinery and equipments continued this year as well. We continued to grow in commercial real properties and energy investments. By increasing our market share from

5.5% to

7%, we have acted as a strong business partner of investors also in

2013.

Determining the needs and demands of investors through intensive regional and company visits, and transferring our existing experiences particularly to our customers in SME (Small and Medium-scale Enterprises) segment, and offering them the best financial solutions in their long-term investments, and providing financial advice services, and supporting our sales team accordingly have been an important factor of this success.

On the other hand, also included among the factors effective on our success were to continue our efforts for expansion of our service network with a view to spreading on a larger area, and to continue creating fund sources in prioritized fields determined, and to spread the projects to be financed in these fields, and to meticulously make our way in portfolio strategy and risk management.

Besides, important provisions of the Law on Financial Leasing, Factoring and Financial Companies that entered into effect in December

2012 gave momentum to segmental growth in general. The operating leasing, software leasing, sell and re-lease products and integral parts and appurtenances are also included in the coverage of financial leasing. The sector grew with the increasing product diversification. We, as İş Leasing, with the regulations issued and the strategy followed by us, made good use of the sector's growth momentum at a fairly good performance level, and realized a growth even above that of the sector as a whole.

What is your growth policy?

Taking the required measures and actions within the frame of our risk policies through growth over a widespread customer portfolio is seen by us as a critical factor in terms of portfolio quality. The transaction volume budgeted by us in line with the targeted market share is intended to be reached through support of projects of a great number of our customers. Since the last several years, we have scheduled and planned both the work flows in the Company and our human resources policy so as to serve a great many of our customers.

We wish to emphasize that it is important for us to particularly take our place as a solution partner beside the SMEs, being the keystone of our economy, and continue to grow together with them.

While the share of financial leasing sector's transaction volume in total investments is around

5% - 6% in our country, this rate is about

20% in Europe and North America. We, as financial leasing sector, basically aim to further increase the awareness about leasing, thereby creating a sustainable transaction volume and carrying the sector's transaction volume to a satisfactory size.

How did you expand your customer base, and what are your goals?

We have strengthened our field organization for the sake of creating a widespread customer base through accessing to more and more customers. In the last quarter of

2013, we have made the required arrangements in our human resources policy for further expansion of our regional structure. To this end, we have opened our branches in Trabzon, Çukurova, Konya, Şişli and Gebze, thus starting our activities thereat. In addition, we have greatly completed the preparations for penetrating into Denizli, Kayseri and Diyarbakır regions. All of these restructuring initiatives aim to further expand and spread our customer base. Through this widespread field organization, our goal is to increase our existing customer base and to continue gaining new customers in the coming years as well.