Share Performance

Share Performance

Due to the effects of the increase in interest rates, and the volatility continuing in markets, and the increasing political tension, and such regional factors of Syria in the recent times, the

2013 growth rate of the Turkish economy has been revised as

3.6%. It is foreseen that external financing potentialities, and investor and consumer confidences, and politics will play a determinant role on growth, and that structural reforms should be focused for the sake of catching a distinct momentum.

In spite of fluctuations in economic conjuncture, İş Leasing continues to be the strong business partner of investors by giving support to investments of every scale. İş Leasing offered to public in

2000, with

42.7% of its capital being currently traded in Borsa Istanbul, constitutes the indicator share certificate of the sector. While Borsa Istanbul and its indices closed the year

2013 with a net fall, İş Leasing (ISFIN) stocks have maintained their existing level through a positive dissociation therefrom.

Aware of its responsibility and meticulously loyal to its corporate governance values and principles, İş Leasing continues to increase and strengthen its success graph by focusing on asset quality and profitability and without sacrificing integrity and transparency.

Corporate Governance

As a part of the rating conducted for the sake of development and transparency of corporate governance practices, İş Leasing has been rated as

9.11 over

10 by SAHA Rating in 2013. Furthermore, according to the World Corporate Governance Index (WCGI), İş Leasing is among the 1st group of companies.

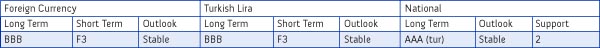

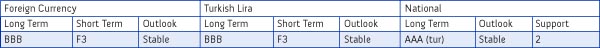

Credit Rating

As a requirement of importance given to corporate governance principles and transparency, our Company's rating is renewed every year. Fitch Ratings has independently confirmed its trust in our Company with AAA rating being the highest national long-term rating that can be given to a Company based in Turkey.